| |

Bringing

all the

factors

together

in the

context

of

income,

Howze

said

that “If

you are

married

with

three or

more

children

the

upper

income

limit is

$54,000

dollars.

So if

you earn

less

than

$54,000

dollars

you fall

into the

round to

qualify

for the

Earned

Income

Tax

Credit...and

“If you

are

single

with

three or

more

children

that

upper

income

limit is

$48,000

dollars.”

(Photo

by HB

Meeks/Tell

Us

Detroit) |

| |

Millions

in Tax

Refunds

Awaits

Detroiters

By Karen

Hudson

Samuels/Tell

Us

Detroit

DETROIT

(Tell Us

Det) -

The tax

season

is well

underway

and the

city of

Detroit

is

urging

residents,

eligible

for the

Earned

Income

Tax

Credit,

to file

a tax

return

so they

can

claim a

surefire

refund

on their

hard-earned

income.

But

surprisingly

not all

of the

estimated

26,000

Detroiters

who

qualify

to

collect

cash on

their

earnings

file a

claim,

leaving

$80

million

in

refunds

on the

table.

Lisa

Howze,

Detroit

Chief

Government

Affairs

Officer,

wants to

change

that.

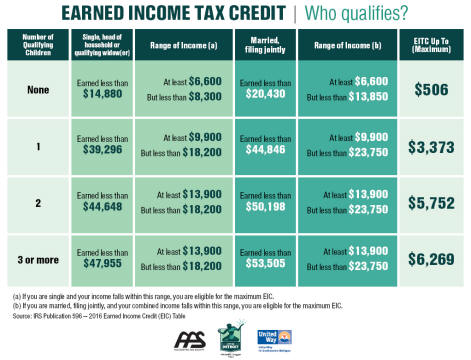

A

certain

level of

income,

marital

status

and

number

of

qualifying

children

are all

factors

that go

into

answering

the

question,

“Do I

qualify

for the

Earned

Income

Tax

Credit?”

Bringing

all the

factors

together

in the

context

of

income,

Howze

said

that “If

you are

married

with

three or

more

children

the

upper

income

limit is

$54,000

dollars.

So if

you earn

less

than

$54,000

dollars

you fall

into the

round to

qualify

for the

Earned

Income

Tax

Credit...and

“If you

are

single

with

three or

more

children

that

upper

income

limit is

$48,000

dollars.”

In the

case of

working

families

Howze

explained

that a

$6,200

Earned

Income

Tax

Credit

could go

a long

way for

a

married

couple

with

three or

more

children

filing a

joint

return.

It could

mean a

savings

account

for

college,

paying

for

bills or

go

toward

purchases

that

puts

money

back

into the

local

economy.

But to

claim

the EITC

Howze

stressed

that a

tax

refund

must be

filed

with the

Internal

Revenue

Service

Making

Detroiters

more

aware of

the

Earned

Income

Tax

Credit

eligibility

and

access

to free

tax

assistance

was the

goal of

Mayor

Duggan

said

Howze

when he

launched

a

campaign

to get

the word

out back

in

January.

To ease

navigating

through

the

qualification

requirements

and to

file a

tax

return,

the city

has

partnered

with the

United

Way call

to

explain

the

benefit.

The

city’s

website

http://www.detroitmi.gov/EITC

has

information

on

scheduling

appointments

to have

taxes

prepared

and also

lists

centers

that

allow

walk-ins,

like

Focus

Hope on

Oakland

Boulevard.

For

people

waiting

for an

appointment

Howze

explained

they is

a Drop

and Go

process

that

offers

free tax

preparation

services

at ten

different

agencies

around

the city

where

individuals

can drop

off

their

tax

related

documents

for

scanning

into a

secure

system.

The

documents

are sent

to a hub

site

where

volunteers

prepare

the

taxes,

in one

week’s

time.

To

understand

why

millions

in

Earned

Income

Tax

Credits

goes

unclaimed,

Howze

pointed

to the

multiplier

effect

of

thousands

of

Detroiters

eligible

for the

EITC but

who

don’t

file tax

returns

or lack

awareness.

To break

down the

impact

Howze

used the

example

of $500

going

unclaimed.

“To a

single

person

with no

children,

who may

have

only

worked a

part

time job

in 2016

they

figure,

I didn’t

make a

lot of

money

this

year so

I don’t

need to

file my

tax

return.

But in

order to

claim

the EITC

they

must

file a

tax

return”

said

Howze.

When the

number

of

Detroiters

eligible

for that

$500 is

multiplied

by the

thousands,

the

unaccounted

for

dollars

add up

pretty

quickly.

Howze

said the

city has

goal of

increasing

the

number

of

people

filing

tax

returns

and

receiving

free

assistance

by 25%.

The goal

for EITC

is to

increase

applications

by 40%

or that

number

is

equals

to 1,000

individuals.

With

access

to free

tax

assistance

and

understanding

of who

qualifies,

Detroiters

can meet

the

April

18, 2017

deadline

to file

a tax

return

and

receive

at

Earned

Income

Tax

Credit.

|

| |

|

|

|

|

|